The aivest Idea

Building a diversified portfolio is no easy task for the personal investor. What investors usually know is how much money they want to invest in one asset class and which currency they will use for the investment. aivest allows for the building of an efficient portfolio with just this input.

The optimizer implementation demonstrated on this website is only one example. Financial service providers offering aivest services to customers can tailor the service in many aspects.

Examples of customizations:

- Introduce alternative instruments/asset classes

- Provide tailored data with different time ranges

- Allow the user to set risk and return parameters per portfolio

- Adjust the probability of instrument selection

However, the optimizer will always build a portfolio on the efficient frontier. The technology - using genetic algorithms with generative AI metadata optimization - does not vary with customization.

aivest's optimizer, as demonstrated on this website, constructs globally diversified minimum variance portfolios. The goal is to construct a portfolio that yields a return similar to a global stock index at comparable risk, but with a much smaller subset of stocks (i.e., while a global stock index contains thousands of different stocks, a typical portfolio generated with this optimizer will contain about 15 different stocks).

Harry Markowitz, who published the basics of the quantitative analysis used by aivest in 1952, received the Nobel Memorial Prize in Economic Sciences in 1990 for his theories. While his fundamental research is widely accepted, it is disputed whether modern portfolio theory (MPT) is still one of the best methods for investing.

Investors do not need to understand the theory behind the optimizer, but may find the following introductions rewarding:

https://en.wikipedia.org/wiki/Harry_Markowitz

https://en.wikipedia.org/wiki/Modern_portfolio_theory

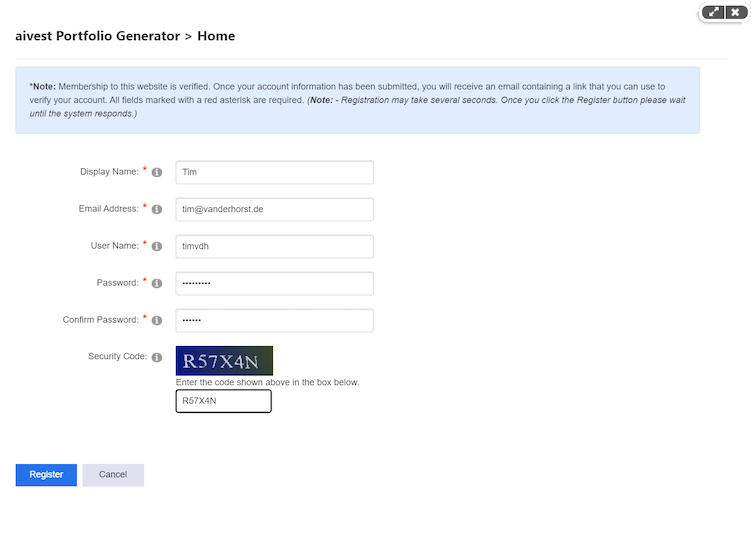

Login / Register

Register a new account or choose "Login" to access an existing account.

Registration is quick and painless. Your email address is required to inform you about changes in your portfolio. Your email address will never be used for anything other than such notifications or very rare system information.

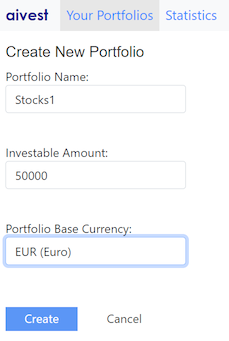

Create Portfolio

Once you are logged in, the "Your Portfolios" menu item becomes available. If you do not have a portfolio yet, you will be asked for a name, the amount (maximum about 500,000 USD for this demo), and the currency.

Currency is important: if the optimizer adds stocks in foreign currencies, the portfolio will consider risks from historical stock price changes and historical relative currency changes.

Click "Create".

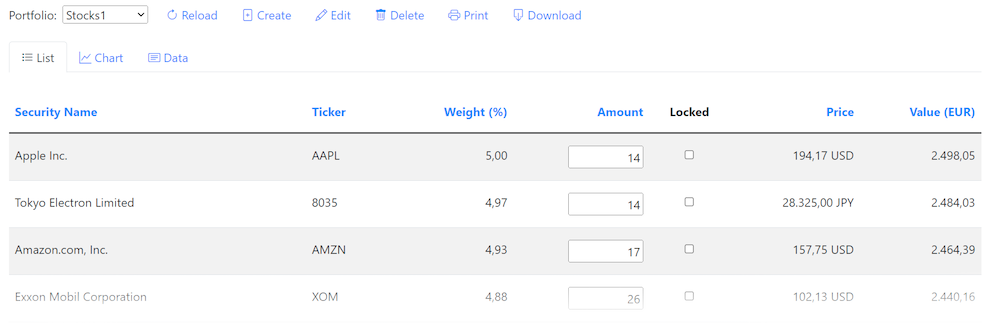

Portfolio Optimization

Creating or reoptimizing a portfolio can take minutes or hours, depending on the current system workload. You will see a status message while queuing/optimization is in progress, but you can leave or close the website. Once the portfolio is ready, you will receive an email notification. Your new portfolio will be listed under "Your Portfolios".

- Weight (%): The total weight of a single stock in your portfolio (considering the last closing price, amount, and currency conversion)

- Amount: The proposed number of stocks to buy.

- Value: The current value of this position (amount * last closing price * currency conversion)

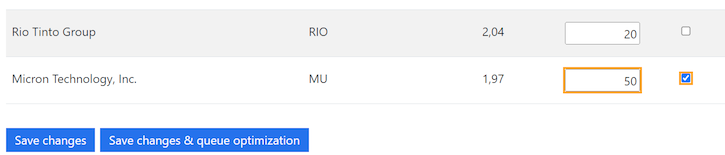

Adjust Positions

You may want to exclude some of the proposed stocks from your portfolio or adjust the weights.

You can change the amount, but reoptimization will only take that number as a starting point and adjust the amount if needed for efficiency. If you want to force a position to a specific number, you must also activate the "Locked" checkbox. You can set the amount to zero and activate "Locked" if you do not want a certain stock in your portfolio.

Extensive locking can lead to a portfolio that the optimizer cannot optimize due to missing opportunities to add positions for an efficient portfolio.

Adjustments will only be taken into account once you reoptimize the portfolio: "Save changes & queue optimization".

Chart

The "Chart" tab displays a theoretical past-performance chart for the last three years - the value over time of your investment if you had entered the positions three years ago. The chart does not reflect new price movements after optimization.

Past performance is no guarantee of future results.